Borrowing interest calculator

So your total monthly payment will be. 5 years Term PIEs Deposit calculator Interest codes Credit ratings explained NZX50 company profiles Private market Bank leverage Deep Freeze List.

Simple Interest Calculator Defintion Formula

Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real cost Real cost of debt.

. The interest rates used in the calculator. The borrowing amount is a guide only. Loan APR which is expressed as a yearly percentage rate represents the true cost of your loan after taking into account the loan interest rate plus the fees charges that you pay when getting a loan.

Our home loan borrowing power calculator could help you work out what you may be able to afford to borrow from a financial institution based on your income and expenses. Borrow more on your Royal Bank of Scotland residential mortgage to help realise your plans for those home improvements dream holiday etc. What is Accrued Interest.

For example if you are buying a car that costs 50000 you borrow 50000 to pay for it. Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years. Simple Regular Interest Calculator.

Some lenders capitalize unpaid interest - add it to the principal amount of your loan. Whether youre borrowing money or investing always look at the compounding periods. If you now have a higher mortgage rate your mortgage payment will be higher to account for the higher interest charges.

Credit Card Interest Calculator Terms Definitions. Disclaimer - Borrowing power. If youre borrowing a larger amount of money your mortgage payment may also be higher due to interest being charged on a larger principal balance.

500 166667 216667. That interest rate is how your lender makes a profit. This is the total amount you are borrowing.

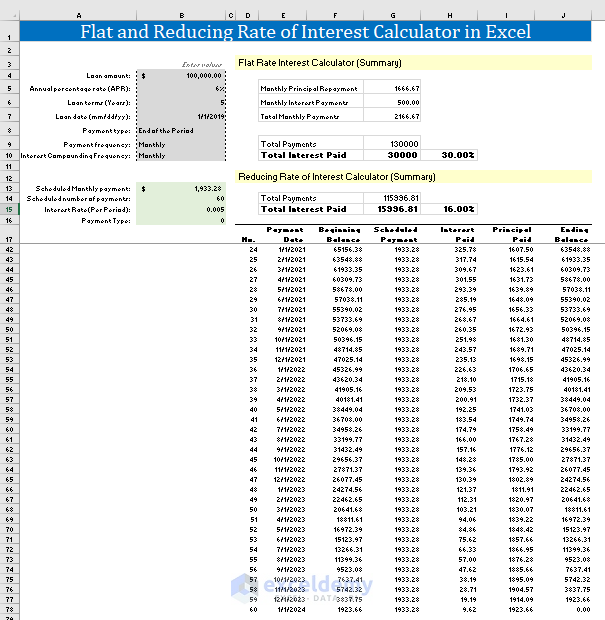

Allows extra payments to be added monthly. This interest is added to the principal and the sum becomes Dereks required repayment to the bank for that. You see the summary of the above calculation using my Flat Rate Interest Calculator in the.

This is the total length of the loan. Our compound interest calculator above limits compounding periods to 100 within a year. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return.

Thats why its important to start sooner than later. Our calculator uses years to calculate the total interest accrued over this timeline. This is your interest that you will pay in every installment.

For the first year we calculate interest as usual. Understanding the different credit card terms and how interest is calculated is an important step to becoming an educated consumer and using your credit card more effectively. Your lender will charge you an interest rate which is a percentage of the money you owe and acts as a sort of rental fee for the money you borrow.

Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you. The resources in this story may also be helpful. This could increase your total loan cost.

The lower the interest rate the higher your borrowing capacity as the total amount of interest applicable to the entire life of the loan will be lower assuming interest rates. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. Changing the interest rate and loan term can have a significant impact on your borrowing power.

Lenders typically charge their clients a rate made up of three parts. Principal Repayment Loan Amount Total Number of Installments. The loan APR factors in these one-time costs associated with borrowing.

When you borrow money from a lender you are required to make repayments typically monthly to repay the money borrowedThis repayment includes the principal taxes insurances and the interestThe amount of interest that accumulates between payments is known as accrued. The best way to work out the actual cost of a business overdraft from a bank is to use our business overdraft calculator which is hereYou can find the total actual rate your bank charges you on your latest bank statement. Are current as indicated on our home loan interest rate pages.

You could potentially in some circumstances borrow up to a maximum of 90 of the value of your home. Perform simple interest calculations to gauge the performance of your investments. Loan Term in years.

Accrued interest is part of the cost borrowing money. Results from the ING Personal Loan Borrowing Power calculator do not constitute an application or offer of credit and do not imply that credit is available. Interest The amount paid for borrowing money.

Compound interest is a powerful concept and it applies to many areas of the investing world. 100 10 10. Shows total interest paid.

For borrowers in NSW making principal and interest repayments on a loan of 350000 with an 80 LVR. You can choose between the refinance first home and investing tabs to. This does not include any down payment you are making.

All applications for credit are subject to INGs credit approval criteria. Be sure to check with your lender before borrowing or look at ways to pay down the interest before it capitalizes. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings.

Rates and repayments are indicative only and subject to change. Are Westpacs standard interest rates and include. The calculator updates results automatically when you change.

How the interest rate and loan term can impact your borrowing power. However mortgage interest isnt the only cost that youll need to pay. There are three main components when determining your total loan interest.

See how much you can afford to borrow based on the amount of income you have available to pay the principal and interest payments. Compounding interest requires more than one period so lets go back to the example of Derek borrowing 100 from the bank for two years at a 10 interest rate. Our Excel mortgage calculator spreadsheet offers the following features.

It has become common these days to. Information and interest rates are current as at the date of publication and are subject to change. Now lets calculate your principal repayments.

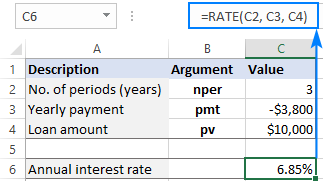

Using Rate Function In Excel To Calculate Interest Rate

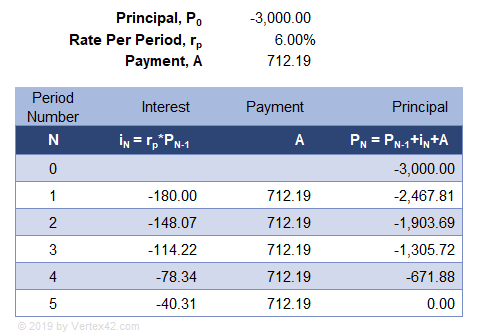

Compound Interest Calculator For Excel

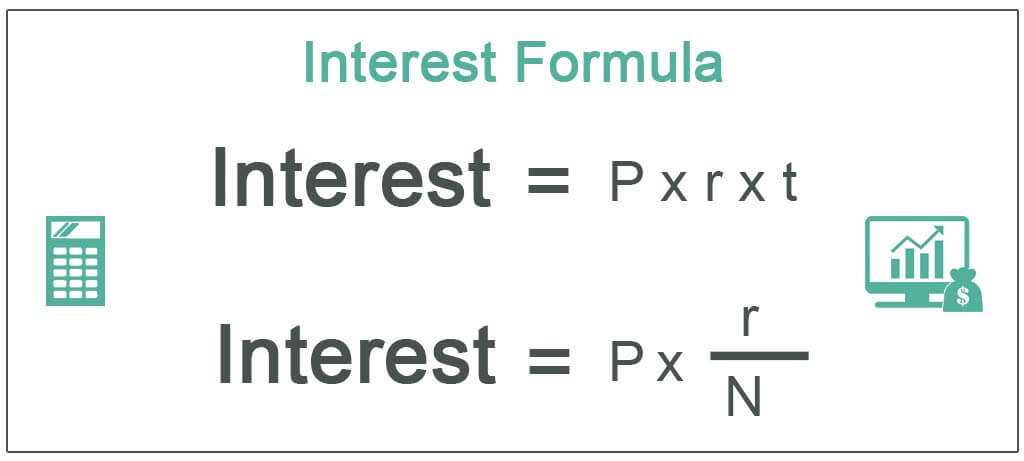

Interest On Loan Meaning Formula How To Calculate

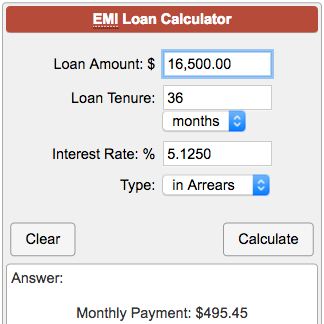

Emi Loan Calculator

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Free Interest Only Loan Calculator For Excel

Simple Loan Calculator

Student Loan Consolidation Calculator Simplify Your Loans Earnest

Compound Interest Calculator For Excel

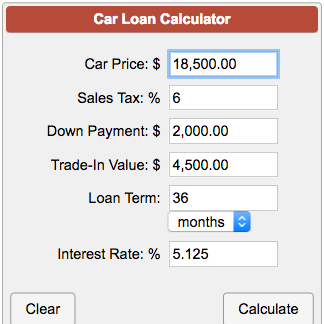

Car Loan Payment Calculator

Mortgage Calculator How Much Monthly Payments Will Cost

Advanced Loan Calculator

Flat And Reducing Rate Of Interest Calculator In Excel Free Download

Excel Formula Calculate Loan Interest In Given Year Exceljet

Loan Calculator Credit Karma

Personal Loan Calculator Student Loan Hero

Excel Formula Calculate Payment For A Loan Exceljet